What is a Credit Score (FICO Score)?

A credit score[ref link= https://www.myfico.com/credit-education/credit-scores] tells financial institutions how creditworthy a consumer is. Lenders will generally use the FICO score (the most popular credit scoring model) to gauge what type of borrower a customer is.

Your credit score helps companies make better decisions about the terms and conditions of your loans with them, which may dictate:

- Whether you’ll receive a loan or line of credit

- Your interest rates on your loans/credit card

- Other benefits and risks of having/keeping you as a client

Benefits of a High Credit Score

Having a high credit score means you’re a financially responsible individual in the eyes of financial institutions. Those with a good score includes people who pay off their debt, make payments on time, and has an established history of good money habits.

Good credit scores improve access to consumer benefits when working with banks or other financial companies. Some benefits of good credit include, but are not limited to:

- More likely to get a loan or mortgage

- Lower interest rates

- Higher spending limits on your credit card

Consequences of a Low Credit Score

Low credit scores indicate high-risk consumers. This is typically someone who may need help paying off loans or credit card statements on time. However, it may simply be the result of not having an established credit history.

Poor credit has consequences that may extend beyond just working with financial institutions. Poor credit may:

- Be linked to increased auto insurance premiums[ref link= https://www.cbsnews.com/news/bad-credit-can-double-auto-insurance-premiums/] but may not necessarily be a direct contributor.

- Affect your ability to secure a job in some states where employer credit checks[ref link= https://creditcards.usnews.com/articles/when-do-employers-check-your-credit] are legal.

What is the Highest Credit Score and What’s Considered A Perfect Score?

850 is the highest credit score you can have on the widely used FICO score model. However, other credit score models may have a max credit score of 900.

You don’t need to max your credit score to receive the full consumer benefits when working with financial institutions. Having a credit score of 800 to 850 (considered ‘Exceptional’) will saving you the most money on loans, credit card interest, mortgages, etc.

The good news is that your credit score is ‘perfect’ once you exceed a score of 800. Once you’re in this bracket, improving your credit score further offers no significant advantages.

What is Your Credit Rating?

Credit scores are classified into one of five credit score ratings, with scores ranging from 300 to 850.

- Poor: Below 580

- Fair: 580-669

- Good: 670-739

- Very Good: 740-799

- Exceptional: At or above 800

Credit score ratings serve as general guidelines. Different financial institutions may have different criteria to determine whether you’re eligible for the best interest rates.

For example, although an ‘Exceptional’ credit rating (credit score of 800 or higher) gets the best rates, your lender may extend those benefits to someone with a credit score of 780.

Even so, you’ll still get decent interest rates with a ‘Very Good’ credit rating (credit score between 740 and 799)

Credit scores in the ‘Good’ rating (between 670 and 739) are the national average.

How Are Credit Scores Calculated?

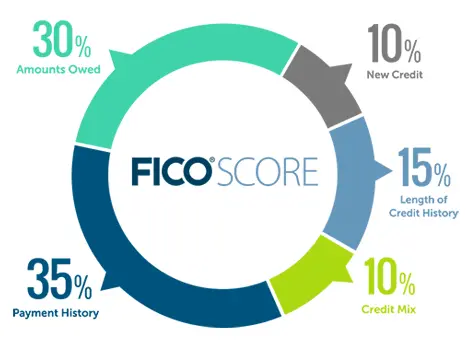

Since the FICO score is the most used credit score models by financial institutions, it’s important to know how the FICO score is calculated.

The breakdown of the FICO score includes:

- Payment History: 35%

- Amounts Owed: 30%

- Length of Credit History: 15%

- Credit Mix: 10%

- New Credit: 10%

Payment History

Payment history makes up the largest percentage of your credit score (for good reason). Lenders want to know that you’ll pay them back on time.

Giving loans to those who have good credit scores will reduce the likelihood of defaulting on a loan, in which the lender doesn’t get repaid.

While your credit score won’t suddenly tank from missing a payment, but consistently late payments will lower your credit score over time.

Amounts Owed

The amount of debt you owe is the second largest contributor to your credit score. Those with large amounts of debt will likely have a harder time paying off loans. In the lender’s eyes, those who spend (and owe) a lot of money are at higher risk of defaulting on a loan.

Your credit score will improve if you have:

- A low combined balance across all accounts

- Fewer accounts with balances

- Paid off a larger percentage of installment loans (mortgage, student, auto)

However, a ‘low balance’ is relative to the spender. Therefore, credit scores factor in the credit utilization ratio, or how much someone spends relative to their credit limit (the max they can spend in a single billing period).

A balance of $1000 a $10,000 credit limit is only a 10% credit utilization ratio (good). But spending the same amount on a $2,000 credit limit would give you a poor credit utilization ratio of 50%.

Length of Credit History

Although less impactful, the length of your credit history still contributes a significant portion (15%) to your credit score.

Your FICO score considers:

- Age of oldest and newest accounts, and the average age of all accounts.

- How long specific accounts have been open.

- How recently you’ve used the accounts.

Even if you don’t use an account, it may still be a good idea to keep it open if it will help inflate your credit score due to its age.

Credit Mix

Successfully managing multiple types of credit will increase your creditworthiness to lenders. As your credit mix only makes up 10% of your credit score, it may not make sense to open new accounts just to bump your credit score.

For example, you may be able to apply for a new credit card and not use it. But trying to boost your credit score by a few points by getting an unnecessary installment loan for a house, car, or tuition makes little sense.

New Credit

Applying for new credit contributes up to 10% of your FICO score. Opening new accounts in a short span of time may indicate to lenders that you may be in dire need of cash, which they view as risky.

Each time you apply for new credit, a financial institution pulls up your credit report and it registers on your credit report as a ‘hard inquiry’ or ‘soft inquiry.’

Hard inquiries, such as applying for an auto loan, credit card, or credit line increase, may lower your score by a few points. Soft credit checks (as part of an employee screening process or viewing your credit report) won’t affect your FICO score.

However, opening new lines of credit may not always be bad for your credit. While a new account may lower your average account age (thus lowering your score), you can increase your credit mix (and increase your score). Furthermore, new credit cards will increase your

How to Build Up Your Credit Score

Most people want the fastest way to build their credit score. But other than reporting and getting false negative marks mistakes on your credit report, building credit can take a while.

Anyone who tells you that you can raise your credit score by 100 points overnight is

Credit Limit

Your credit limit is the most you can spend in a billing cycle (usually a month) before your card issuer requires payment. So, if you max out your $5000 credit card limit, you can no longer use that card in that billing cycle unless you make a payment.

Credit limits increase with your ability to pay (income) and your financial trustworthiness (credit score). A high credit limit benefits you because it lowers your credit utilization ratio, which, in turn, improves your credit score.

To illustrate credit utilization ratio, suppose credit card user A has a $10,000 credit limit and user B maxes out their credit at $2000. If they each spend $1,000, A has spent 10% of their total credit limit ($1,000 out of $10,000) while B has spent 50% of theirs ($1,000 out of $2,000).

Pay Off Your Debt

Automatic Payments or Pay on Time

Automatic payments prevent you from leaving an unpaid balance on your credit card, which will wreak havoc on your credit score and finances. It’s a good way to take the hassle out of manual payments and can prevent late payment marks on your credit report.

Otherwise, you should always make payments on time and in full. With an average credit card APR at 16%, few can afford to consistently make late credit card payments. The interest can easily spiral out of control, beyond your means to pay.

Sometimes, it’s not about the inability to pay, but forgetting to make the payments before it’s due. Usually, the payment deadline to make interest-free payments is several weeks after receiving your credit card statement. Interest only applies to an unpaid balance after this deadline.

Increase your Credit Limit

Increasing your credit limit will decrease your credit utilization (if your spending remains the same). You can open a few lines of credit to increase your credit limit or request a credit limit increase.

Note that doing either will result in a hard inquiry, which may temporarily drop your credit score. This is only temporary, as the hard inquiries disappear from your credit report after 24 months, if they make a dent at all.

While you may suffer a lower credit score in the short-term, keep up your good credit habits and you’ll enjoy a higher credit score in the long-term.

Keep Credit Cards Open

Deciding when to keep your credit cards active or closing your account will help you improve your credit score. Recall that the older your account, the more weight it has on increasing your credit score.

Even if you’ve stopped using a credit card for a long time, you can keep it and benefit from a higher average age between your accounts. You’ll also have a higher credit limit which will decrease your credit utilization ratio.

Protect Your Credit Score and Credit Usage

Credit Freeze

A credit freeze will prevent anyone (including you) from using your information to apply for credit using your information. Otherwise, a thief may use your identity to open several credit cards and lower your credit score through:

- Multiple hard inquiries

- Decreasing your average account age

- Increasing your total balance across all accounts

- Increasing your credit utilization ratio

- Failing to pay off credit card statements

If you don’t need to apply for new credit, it’s safer to freeze your credit. As it won’t negatively impact your credit score, there are few downsides to locking everyone out. You can easily unfreeze your credit at any time.

To freeze your credit, contact the three major credit bureaus (Equifax, Experian, and TransUnion) individually to freeze your credit at each one.

Fraud Protection and Chargebacks

The Fair Credit Billing Act protects consumers from unauthorized charges greater than $50 on a lost or stolen credit card. While this means you can pay up to $50 for a fraudulent charge, some credit card issuers will completely let you off the hook for unauthorized charges.

Make sure to only use this chargeback feature on truly fraudulent charges, or you’ll be stealing from legitimate businesses!

Virtual cards

Some credit cards offer temporary virtual account numbers so you can shop without giving merchants your actual credit card number. This helps you avoid data breaches or insecure internet connections that may compromise your credit card information and unauthorized usage.

Once you’re done shopping, disable the virtual account number so that nobody can use it again.

Purchase Alerts

You may opt to receive purchase notifications when there are transactions on your credit card. These alerts will notify you of any fraudulent charges, allowing you to call your bank to file a dispute.

Otherwise, fraudulent charges will increase your monthly spending balance and your credit utilization ratio, both of which will decrease your credit score. If you don’t swipe your card one month and neglect to check that someone else has, you’ll have a missed payment mark on your credit report as well.

Card Freezes and Replacement

If you have a lost or stolen credit card, you should immediately place a freeze on the card (sometimes through an app) and report it to your card issuer. The freeze will lock the card from additional spending until you get ahold of customer service to cancel the card number.

You’ll receive a new card in the mail, along with new credit card numbers in case the old numbers were compromised. That means you’ll need to update payment information on recurring services to continue receiving them.

Spend Within Your Means

Although credit cards allow you to temporarily spend more cash than you have on hand, many people overspend and are unable to pay it back. Therefore, you should only buy what you can afford. Failing to do so will decrease your credit score through increased account balances, higher credit utilization ratio, and missed payments.

Conclusion

You can build credit naturally through regular and responsible credit card usage. Since your credit score is a sign of being a trustworthy borrower, it can help you secure loans for a car, house mortgage, tuition, etc.

Those with high credit scores are more likely to get a loan and at lower interest rates because they are low-risk. On larger loans such as a mortgage, lower interest rates can add up significantly.

Back to top