Options Trading Guide for Beginners

Table of Contents

- Introduction to Options Trading

- Options Primer

- Options Basics

- Options Profits

- Options Pricing

- Options Strategies

Options Profitability Overview

We can calculate option profits with a simple formula:

Profit = Earnings – Losses

However, there are various ways to generate profits from options. Most of these ways generally fall into one of the two categories:

- Trading option contracts

- Exercising the option

Profits from Trading Options

Options trading versatility results from the ability to buy and sell contracts in many different ways.

Profits generally result from buying something first, then selling at a higher price later. While options also work this way, it’s not the only way.

Based on this ‘buy first’ and ‘sell later’ model, buying the option is the opening trade, and reselling it is the closing trade.

A buy to open order creates an open position, or ownership, of +1 contract. The contract allows us to exercise at any time. Later we can also sell to close the position, negating the right to exercise and our position.

We can also ‘sell first’ and ‘buy later’ by initiating a sell to open order and closing the position with a buy to close order.

Sell to open orders create an open position of -1 contract. If the option holder exercises, we would be held liable to fulfill the assigned contract. A buy to close order would revert our position to 0, negating the risk of assignment.

If the option expires in either of the above scenarios, we treat the closing trade as $0. Option holders would pay a premium and get $0 in return, losing the entire premium. Meanwhile, option writers sell at the premium and pay $0 to close the trade, earning the entire premium.

We can calculate our profit from trading options by subtracting our premium paid from our premium collected.

Profit = Premium Collected – Premium Paid

Profits from Exercising Options

We can profit from exercising options when our earnings from the underlying trade exceed our premium paid. Note that we can only exercise an option when doing so is more favorable than trading at fair market value.

To determine how favorable it is to hold an option, we can compare the strike price relative to the share price using the following terms:

- in-the-money,

- at-the-money,

- out-of-the-money.

In-the-money (ITM) options refer to options whose underlying is trading at a better price than the strike price. Remember our analogy: call up, put down. Exercising a call is more profitable when the share price goes up, while put options benefit from a downward price movement.

The more earnings an option’s underlying trade generates, the deeper ITM the option is. If the underlying trade earns $5, the option is $5 ITM. For example, a $20 call is $5 ITM when its underlying share value is $25.

At-the-money (ATM) options have an underlying stock trading at the strike price. Since it’s rare for the share and strike prices to match exactly, ATM refers to the option closest to the share price. An $85 option whose underlying is trading at $84.73 can be considered ATM.

The option is out-of-the-money (OTM) if the underlying stock is ineligible for exercise because it hasn’t reached the strike price. An option $7 away from the strike price is $7 OTM. For example, a $40 put option has an underlying currently trading at $47.

Upon exercising the option, we first have to calculate the underlying trade’s earnings by taking the difference between the share price and the strike price. Then we must subtract the premium we paid for the opening trade.

Profit = Earnings – Premium Paid

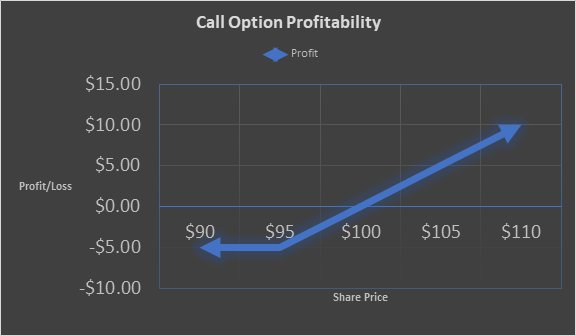

Exercising Call Options

‘Call’ options allow us to buy 100 shares of stocks at the strike price or stock price, whichever is lower. The higher the price goes, the more profitable our option is.

We can calculate our profit from exercising the call option by subtracting our premium paid from the underlying trade’s earnings.

Profit = Earnings – Premium Paid

Earnings = 100 Shares * (Share Price – Strike Price)

Suppose we bought a $100 call at a $5 premium. At 100 share per contract, we would pay $500 in premium. If the share price rose to $110 ($10 ITM), we could exercise and pay $100 per share, even though the stock value is $10 more.

Assuming we bought the shares at $100 and resold at $110, Our earnings would be 100 * ($110 – $100) = $1000. After taking into account our premium of $500, our final profit is $1000 – $500 = $500.

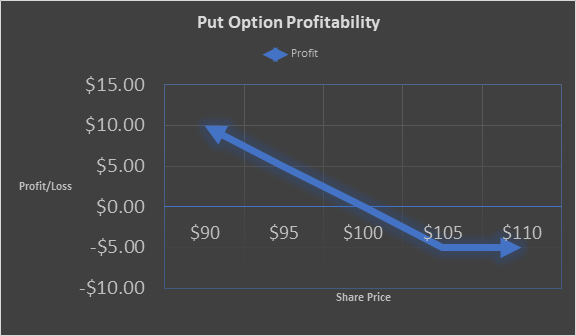

Exercising Put Options

‘Put’ options allow us to sell 100 shares of stock at the strike price or stock price, whichever is higher. The lower the price goes, the more profitable our option is.

We can calculate our profit from exercising the put option by subtracting our premium paid from the underlying trade’s earnings.

Profit = Earnings – Premium Paid

Earnings = 100 Shares * (Strike Price – Share Price)

Suppose we bought a $105 put at a $5 premium. At 100 share per contract, we would pay $500 in premium. If the share price fell to $90 ($15 ITM), we could exercise and sell at $105 per share, even though the stock value is $15 less.

Assuming we bought the shares at $90 and resold at $105, our earnings would be 100 * ($105 – $90) = $1500. After taking into account our premium of $500, our final profit is $1500 – $500 = $0.